Built on 30+ Years of Multifamily Experience

A Track Record Built on Discipline and Results

Over three decades, Steadfast has delivered consistent, risk-adjusted performance—spanning REITs, private offerings, and affordable housing investments. Historical results include double-digit annual returns and multiple full-cycle realizations across diverse multifamily strategies.

Individual Private Multifamily Properties

Encompassed privately held market-rate apartment communities acquired, managed, and sold by Steadfast outside its REIT programs.

- 37 properties

- 9,622 units

Steadfast Affordable Apartments

Includes a nationwide mix of affordable and mixed-income apartment communities developed, owned, and managed by Steadfast over multiple decades.

- 68 properties

- 9,589 units

Steadfast Apartment REIT (“STAR”) - IRT Merger

STAR REIT properties valued at $4.68 billion that merged with Independence Realty Trust in 2021.

- 68 properties

- 21,394 units

Steadfast Apartment REIT (“STAR”) - non-IRT

Represents the portion of the STAR REIT portfolio that remained privately held by Steadfast following the IRT merger.

- 51 properties

- 12,335 units

Download the Full Performance Report

The summary metrics above offer a high-level view of Steadfast’s experience. The full performance report goes deeper—providing comprehensive property-level detail so you can understand how each investment performed across different markets, strategies, and time periods.

We created this report for investors who want transparency—not just summaries. If you’re evaluating whether to invest with Steadfast, this is the most complete source of historical performance data available.

Get the full report and explore the details behind Steadfast’s multifamily investment history.

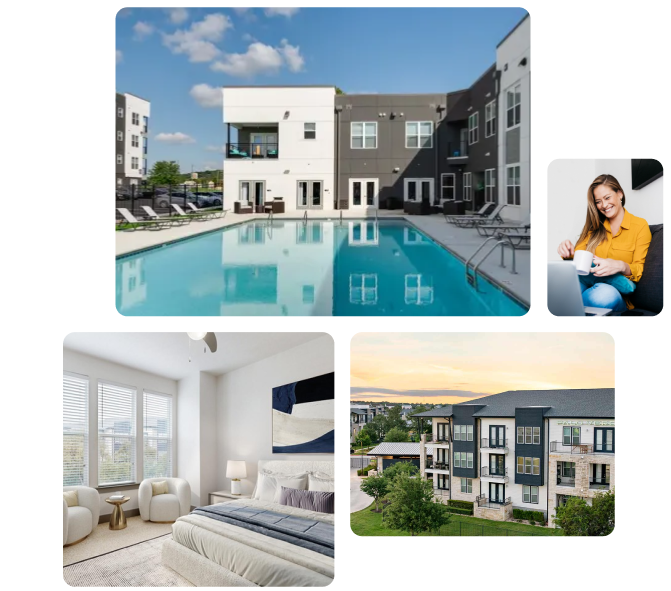

The Steadfast Difference

Our approach is built around alignment, operational discipline, and market selection informed by years of experience across cycles. These principles guide how we source opportunities, structure financing, and steward investor capital.

To see how these principles come together in practice, explore our full Investment Thesis →

Skin in the Game:

Minimal Fees, Performance-Based Incentives:

Fully Integrated Platform:

At Steadfast, we’ve navigated multiple market cycles over the past three decades. Today, the multifamily sector presents a rare window of opportunity—defined by resilient demand, evolving supply, and favorable pricing. Our goal remains the same: preserve capital, generate durable cash flow, and build wealth over time.

– Bill Stoll, Chief Investment Officer