A Smarter Path to Multifamily Investing

1. We Acquire & Stabilize First Before any opportunity reaches you, Steadfast acquires the property with our own capital, secures long-term fixed-rate financing, and addresses key operational issues such as lease-up, deferred maintenance, or expense controls. You’re investing in a stabilized, cash-flowing asset—not a speculative plan.

2. You Review Curated Opportunities Once our management team has established operational control, opportunities are offered exclusively through the Steadfast Direct platform. Each deal includes full offering documents, market research, and transparent reporting so you can evaluate fit for your portfolio.

3. Invest Alongside Us Steadfast and its principals co-invest 10–20% of the total equity in every deal. With minimum investments starting at $25,000, you can participate directly in institutional-quality multifamily assets, knowing our capital is working right alongside yours.

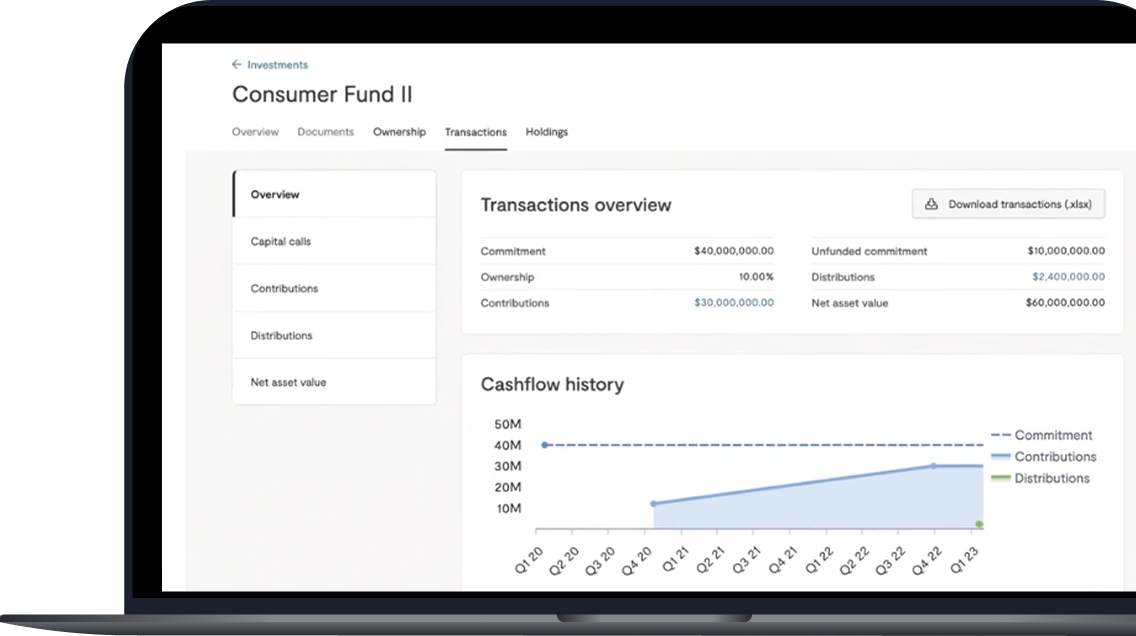

4. Earn Distributions & Track Performance For offerings structured with a current cash yield, your returns begin accruing immediately upon funding. Quarterly distributions are then paid out on schedule, alongside detailed reporting through our secure online portal. You’ll also have continuous access to property updates, financials, and tax documents—all in one place.

5. Realize Long-Term Value With a typical 5–7 year hold, our disciplined approach targets both ongoing cash flow and capital appreciation at exit. We underwrite conservatively, structure with downside protection, and seek to outperform by delivering steady results through cycles.

Onboarding & Portal Access

- Complete verification and funding

- Access deal documents, tax forms, and capital account statements

- Track performance and manage distributions

Common Questions from New Investors

Who can invest: According to the U.S. Securities and Exchange Commission (SEC), you qualify as an accredited investor if any one of the following criteria is true:

- Income: $200k+ (individual) or $300k+ (joint) in each of the last two years, with a reasonable expectation of the same this year; or

- Net worth: Over $1M (individually or jointly), excluding your primary residence; or

- Professional: Hold Series 7, 65, or 82; are a director/executive officer/GP of the issuer; or a “knowledgeable employee” of a private fund; or

- Entities: Trusts or entities with $5M+ in assets (not formed solely for this investment), family offices with $5M+ AUM (and their family clients), or entities where all owners are accredited.

Targets are specific to each offering and are not guarantees. Many offerings pursue a mix of current income and capital appreciation, with distributions typically paid quarterly after debt service and reserves. We publish the full waterfall, preferred return, and hurdle structure for each investment.

We plan for what we can control and build cushions for what we can’t.

Here’s what that looks like:

- Underwrite for the downside. We cap rent-growth assumptions and run “what-ifs” on vacancy, expenses, and exit values. Plans must work without heroic assumptions and lean towards conservatism.

- Debt for stability. We primarily use fixed-rate agency loans at moderate leverage (about 60–70% LTV), sized to ≥1.25× DSCR from day one—i.e., income can comfortably cover the debt service. That keeps payments predictable and avoids the need for a refinance to make the plan work. If a different structure better suits a specific deal, we clearly outline it in the offering.

- Reserves and scoped capex. We fund operating and replacement reserves up front and fully scope capital work. We pilot renovations to confirm costs and rent increases before scaling.

- Insurance discipline. We competitively bid coverage, right-size deductibles, and invest in risk-reduction (roof, systems, safety). We avoid markets where insurance volatility overwhelms NOI.

- Taxes and policy tools. We model assessments conservatively and pursue appeals where appropriate. In many markets, attainable-housing communities can qualify for local programs (e.g., abatements/exemptions) that lower expenses in exchange for income/rent commitments.

- Example: In Texas, some assets can be structured with a Public Facility Corporation (PFC) partnership that provides up to a 100% property-tax exemption during the compliance term. Our Boerne asset uses a PFC structure; terms and covenants are detailed in the offering documents. Note: Such programs are case-by-case and not universal.

- Example: In Texas, some assets can be structured with a Public Facility Corporation (PFC) partnership that provides up to a 100% property-tax exemption during the compliance term. Our Boerne asset uses a PFC structure; terms and covenants are detailed in the offering documents. Note: Such programs are case-by-case and not universal.

- Operating control. As an owner-operator, our in-house teams manage the levers that move NOI: rent pricing and renewals, fewer vacant days between residents, expense control, and targeted, cost-controlled upgrades.

- Flexibility if conditions change. We keep multiple paths to value, which can include => operating for income, renovating where payback is clear, and selling or refinancing when warranted. If needed, we can adjust distributions to protect the asset and communicate with our investors why and what’s next.

Bottom Line: To mitigate today’s market volatility, we are leaning towards more conservative underwriting assumptions, primarily fixed-rate debt sized to coverage, ample reserves, policy tools where sensible, and day-to-day operating control.

Our mission is to create long-term value for our investors through disciplined acquisitions, operational excellence, and a deep sense of responsibility to the people we serve.

– Rod Emery, CEO

.jpg)