We Acquire and Stabilize First

Steadfast acquires each property with its own capital, completes diligence, and secures long-term financing before opening to investors. You invest in an operating asset, not a speculative plan.

Our mission is to create long-term value for our investors through disciplined acquisitions, operational excellence, and a deep sense of responsibility to the people we serve.

– Rod Emery, CEO

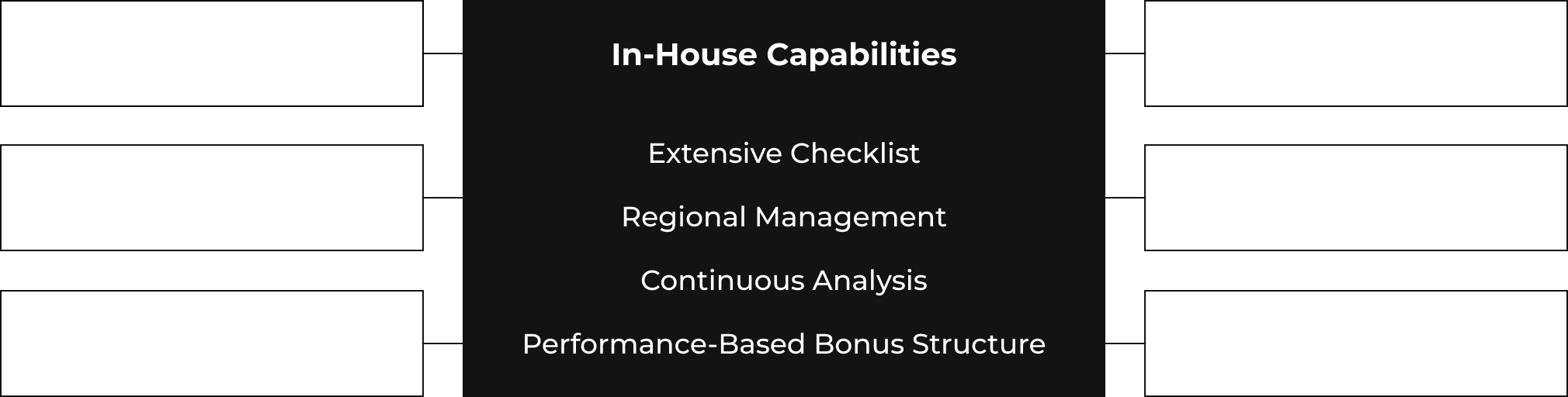

Unlike sponsors who outsource, Steadfast executes the full investment lifecycle in-house — acquisitions, property management, asset management, investor reporting, legal, and accounting. This vertical integration creates tighter oversight, faster decisions, and one accountable team protecting investor capital.