In real estate investing, timing often matters as much as choosing the right asset to invest in.

Over the past few years, rising interest rates, stubbornly high construction costs, and mismatched seller expectations created one of the most difficult acquisition environments in recent memory.1

Now, with values resetting, new development slowing, and renter demand continuing to build, we believe conditions are lining up for a new chapter.

For the first time, we’re sharing our approach directly with accredited investors through Steadfast Direct, beginning with the release of our Investment Thesis.

What We’re Seeing in the Market

Multifamily has essentially been in a “mini-recession” since 2021. Rates moved from 1% to over 5% on the 10-year Treasury, making deals tough to pencil.2 Developers continued building, creating more supply than demand could absorb in certain markets. Rents flattened or even fell in some high-growth metros.3

That picture has been changing.

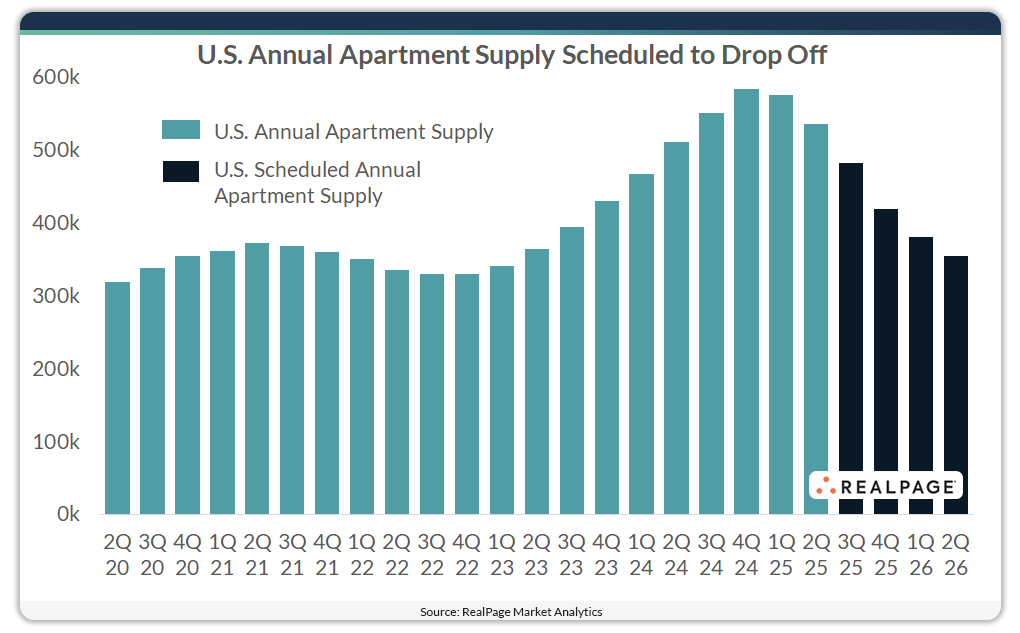

Development is “falling off a cliff” over the next several quarters, according to our CIO, Bill Stoll — largely because high construction costs and tighter lending have made new projects financially infeasible.

Data from RealPage shows that national apartment completions are set to decline even further, nearly 34% in the next 12 months, one of the sharpest supply pullbacks in over a decade.4

Practically, fewer new buildings coming online means existing properties face less head-to-head competition. Vacant existing units tend to fill faster, discounting declines, and occupancy stabilizes, creating the conditions for rent growth to normalize as supply thins out.

Out of the 50 largest U.S. markets, only ten are expected to see any increase in deliveries, and most of those gains are concentrated in a handful of places like Los Angeles, San Diego, and Detroit.4

Figure 1: U.S. Annual Apartment Supply Scheduled to Drop Off

Chart Source: RealPage, https://www.realpage.com/analytics/apartment-markets-deliveries-increase/

With fewer projects breaking ground and absorption still strong, we believe the imbalance will correct, supporting healthier rent growth starting in 2026. In Bill’s words: “It costs more to build than to buy today.” For disciplined buyers, that presents an opening.

CBRE notes that underwriting assumptions have also improved, with going-in cap rates compressing slightly and rent growth expectations rising to ~2.8% for core assets and 3.3% for value-add assets — signaling that investors are regaining confidence as the market stabilizes.5

Where We’re Focused

Steadfast has long concentrated on suburban, renter-by-necessity housing, apartments where teachers, nurses, and young families live. These communities have proven resilient through cycles, and they remain our focus as we re-enter.

Regionally, supply has surged in places like Austin, Nashville, and Raleigh-Durham, weighing on rents. By contrast, markets such as Indianapolis, Dallas–Fort Worth, and parts of the Southeast and Midwest are showing steadier fundamentals.6

Our strategy avoids oversupplied cores and instead emphasizes durable submarkets with population and job growth.

How We’re Approaching Risk

Cycles don’t erase risks, they sharpen them.

We are factoring higher insurance and labor costs into every pro forma, and we avoid underwriting to perfection. Instead, we assume steady but modest rent growth of 2–3% annually over a 5–10 year hold, leaving room for both upswings and slowdowns.

The goal is not to chase aggressive projections, but to deliver through disciplined entry points, conservative leverage, and active asset management. That approach has guided Steadfast across multiple market cycles and it’s the foundation of what we’re bringing forward in Steadfast Direct.

What Our Investment Thesis Covers

✔ Why Multifamily Today: The backdrop shaping today’s opportunity.

✔ Investment Strategy: Where we focus, and why.

✔ Underwriting Philosophy: The guardrails that guide us as we evaluate opportunities.

✔ Protecting Investor Capital: How we think about alignment with investors.

✔ Market Selection: What we tend to avoid, and what we generally favor.

✔ Our Operating Edge: Why execution matters and what distinguishes Steadfast Direct from others in the game.

✔ CIO’s Perspective: Hear from our Chief Investment Officer how we’re interpreting this cycle, why our “Where America Lives” focus creates both resilience and impact, and what partnering with Steadfast Direct means for investors.

Explore our strategy in depth.

Why all of this matters for investors: Households are renting longer, homeownership is becoming less attainable, and the country needs millions more apartments over the next decade, creating a runway for opportunities in apartment investing.

Steadfast Direct’s Investment Thesis brings these threads together: capital markets and demographics, target markets and asset profile, and the risk disciplines that guide how we underwrite and operate, and explains why we’re beginning to deploy again. For the first time, we’re also inviting accredited investors to participate directly alongside us through Steadfast Direct.

Disclaimer: The information provided herein is for informational and educational purposes only and should not be construed as investment advice, an offer, or a solicitation to buy or sell any security. Private real estate investments involve significant risks, including loss of principal, and are intended for accredited investors who understand and can bear those risks. Past performance is not indicative of future results. Forward-looking statements are based on current assumptions and expectations; actual results may differ materially. Investors should conduct their own due diligence and consult with their financial, legal, and tax advisors before making any investment decision.

Footnotes

- https://www.cushmanwakefield.com/en/united-states/insights/market-matters-exploring-real-estate-investment-conditions-and-trends#archives

- https://www.multifamilydive.com/news/multifamily-investment-strategy-apartment-construction-federal-reserve/751875/

- https://www.credaily.com/newsletters/multifamily-demand-hits-25-year-high-as-new-construction-plummets/

- https://www.realpage.com/analytics/apartment-markets-deliveries-increase/

- https://www.cbre.com/insights/briefs/multifamily-underwriting-metrics-improve-in-q2

- https://www.credaily.com/briefs/rent-growth-strongest-in-affordable-rust-belt-and-northeast-cities/